As part of the projections to correct distortions and re-drive the economy, the updating of the legal provisions that regulate the non-state economic actors is ratified, under the principle of not going backwards, but to continue advancing in their correct insertion in the economic and social development of the country and that they fulfill their role as complementary actors of the economy.

As part of the projections to correct distortions and re-drive the economy, the updating of the legal provisions that regulate the non-state economic actors is ratified, under the principle of not going backwards, but to continue advancing in their correct insertion in the economic and social development of the country and that they fulfill their role as complementary actors of the economy.

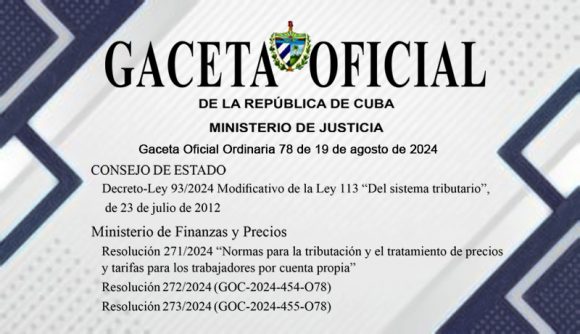

With this objective in mind, the Official Gazette published today several decrees to update the regulations for non-state economic actors. Among them are the Decree Laws on micro, small and medium-sized companies, non-agricultural cooperatives and self-employment. As well as those referring to contraventions in the exercise of self-employment, micro, small and medium-sized enterprises and non-agricultural cooperatives.

Resolutions are also published regarding the procedures for the creation, merger, spin-off and extinction, aspects of economic contracting and bidding procedures in the relations of state entities with non-state economic actors, and the rules for taxation and the treatment of prices and tariffs for self-employed workers. These resolutions become effective 30 days after their publication in the Official Gazette.

The purpose of the adjustments is also to consolidate the application of taxes under the principles of generality and tax equity, as well as to enhance the collection of budgetary revenues in accordance with the economic capacity of each taxpayer.

These tax adjustments leave without effect Decree Laws 354, of February 23, 2018 and 49, of August 6, 2021, and Articles 60, 61, 62, 63, 64 and 65 and the Third Special Provision of the referred Law 113 of 2012.

1. The elimination of the simplified taxation regime for the payment of taxes is ratified, which generalizes a single general taxation regime applicable to all non-state economic actors (effective as of January 1, 2024).

2. More than two years after the beginning of the process of creation of MSMEs, these have demonstrated their contributive capacity and it is necessary to increase the income to the State Budget, therefore, the benefit that the partners had, exempted from the payment of personal income tax for the dividends they obtain in their first year of operations, is eliminated.

In the case of self-employed workers, the exemption of payments for the first three months of starting operations is eliminated.

Tax incentives must be temporary to stimulate an activity or sectors of the economy.

3. The accounting of operations is updated in correspondence with the annual income obtained by the self-employed.

4. In the exercise of his activity, the self-employed worker who annually obtains income in excess of five hundred thousand pesos (500,000.00 CUP), is obliged to keep the accounting of his operations, for tax purposes, based on the Cuban Financial Reporting Standards.

5. As part of the updating of the tax system, the accounting of self-employed workers is simplified, and those who obtain annual income of less than five hundred thousand pesos (500,000.00 CUP), are only obliged to keep the Income and Expense Control Register and the documentation evidencing the operations.

6. The payment of the Tax for the transfer of goods and inheritances shall be made at the moment of the formalization of the transfer act by means of the notarial deed and not at the Property Registry.

7. It is based on the high level of non-compliance in the payment of these taxes under the rules of in the term of 30 days once the notarial deed of the act of sale or donation has been formalized, fundamentally of the houses, since there is no limitation for the use and enjoyment of the property, even when the act of transfer is not registered in the Property Registry.

8. Five percent (5%) is recognized as the tax rate for the payment of the Tax on the Use of Labor Force.

9. The amount equivalent to the minimum salary established by the MTSS is recognized as the minimum remuneration paid to each worker for the calculation of the Tax on the Use of the Work Force.

In the case of self-employed workers who carry out commercial fishing activities, the form of taxation is modified:

– he/she is taxed under the General Regime.

– The scope of the activity is extended from the authorization of the free commercialization of the products.

– It is obliged to open and operate a fiscal bank account, as the rest of the taxpayers natural persons.

– They are exempted from the presentation and payment of the Personal Income Tax Affidavit.

In order to avoid legislative dispersion, Resolutions 345, 346, 347, 382 of 2021, 246 of 2023, all from the Ministry of Finance and Prices, are repealed.

Translated and edited by Dayla Perez Ortiz.